RoboForex No Deposit Bonus

Home » Bonus

RoboForex provides Malaysian traders access to several promotional opportunities including welcome benefits. The welcome program offers MYR 120 (30 USD) for new traders without requiring initial deposit. Program participation enables real market trading experience through standard trading accounts.

Account registration and verification completion activates promotional features automatically. Trading conditions follow standard account parameters with specific promotional requirements. Malaysian traders access promotional benefits through Pro and ProCent accounts.

Welcome Program Features

Feature | Details | Requirements |

Initial Amount | MYR 120 | Account verification |

Trading Period | 30 days | Active trading |

Withdrawal | Available | Turnover completion |

Platforms | MT4/MT5 | Standard access |

Deposit Promotion Structure

Additional promotional opportunities include deposit matching programs for Malaysian traders. The standard deposit program provides up to 120% matching on qualifying deposits starting from MYR 40. Premium account deposits receive enhanced matching percentages based on deposit amount.

Promotional credit applies to trading balance enabling increased position sizing. Trading volume requirements determine promotional credit conversion to withdrawable funds. Credit utilization follows standard margin calculation procedures.

Deposit Program Levels

- Standard: 50% match up to MYR 400

- Premium: 100% match up to MYR 2,000

- VIP: 120% match up to MYR 4,000

- Status bonuses: Additional 20% based on account level

- Loyalty rewards: Increased matching for regular traders

Verification Requirements

Account verification follows Malaysian financial regulations protecting market participants. Document submission proceeds through secure transmission channels protecting client information. Verification teams process submissions following established security protocols.

Malaysian traders provide government-issued identification confirming eligibility. Proof of residence documentation requires recent dated materials following regulatory standards.

Required Documentation

- Government ID

- Proof of residence

- Bank statement

- Additional verification

- Corporate documents

Promotional Terms Overview

Program participation requires acceptance of specific trading conditions ensuring fair market participation. Trading volume requirements calculate based on credit amount and account type. Position holding periods affect promotional credit utilization.

Credit removal occurs if trading requirements remain incomplete within specified timeframes. Support teams monitor promotional trading activity ensuring compliance with program terms.

Trading Requirements

- Minimum trading volume completion

- Position duration specifications

- Instrument restrictions

- Time limit compliance

- Regular trading activity

Trading Conditions

Trading accounts provide access to multiple instrument categories including forex pairs and commodities. Market execution ensures rapid order processing without intervention. Position sizes adjust according to account equity and margin requirements.

Spread structures vary by account type and instrument selection. Leverage options range from 1:1 to 1:2000 based on account configuration.

Account Parameters

- Variable spreads

- Multiple order types

- Market execution

- Position management

- Risk controls

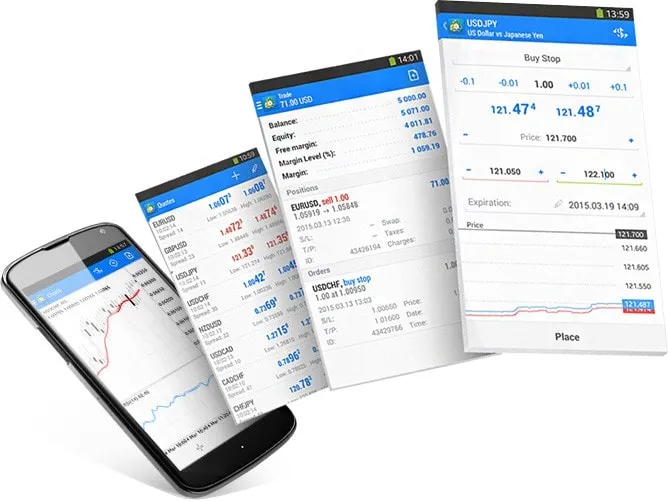

Trading Platform Access

Platform selection includes MetaTrader 4, MetaTrader 5, and R StocksTrader options. Trading interfaces provide comprehensive market access through desktop and mobile applications. Platform features include technical analysis tools supporting trading decisions.

Malaysian traders access markets through preferred platform configurations. System capabilities include automated trading and advanced order management.

Platform Features

| Feature | MT4/MT5 | R StocksTrader |

| Charts | Advanced | Standard |

| Orders | All types | Market/Limit |

| Analysis | Full suite | Basic tools |

Account Management

Management tools provide transaction monitoring and position tracking capabilities. Trading history maintains complete records for performance analysis. Report generation systems produce detailed activity summaries.

Account interfaces display real-time information supporting trading decisions. Management features include portfolio analysis and risk assessment tools.

Management Features

- Performance tracking

- Position monitoring

- Risk assessment

- Report generation

- Portfolio analysis

Financial Operations

Malaysian ringgit transactions process through authorized payment channels following security protocols. Deposit methods include local bank transfers and electronic payment systems. Transaction processing maintains compliance with Malaysian banking regulations.

Financial departments handle currency operations through secure systems. Payment processing times vary by selected method and verification status.

Processing Timeframes

- Electronic payments: Instant

- Bank transfers: 1-3 days

- Card payments: Immediate

- Withdrawals: 1-5 days

- Internal transfers: Instant

Market Analysis Tools

Analysis resources provide market information through multiple data sources. Technical indicators support trading strategy development and execution. Market data streams maintain current price information across instruments.

Analysis capabilities integrate with trading platforms for efficient monitoring. Tool selection includes standard and advanced technical indicators.

Support Services

Support channels maintain availability through email, chat, and telephone communications. Technical teams assist with platform configuration and trading operations. Response priorities adjust based on issue urgency and market conditions.

Malaysian traders access support through local contact options during business hours. Emergency support remains available through continuous operation channels.

Frequently Asked Questions

Account features activate progressively following verification completion. Initial features become available after basic verification with full access after complete documentation review.

Account parameters remain adjustable through platform settings and support requests. Changes require appropriate verification level completion.

Trading platforms provide equal access to account features. Platform selection affects available technical tools and interface options without impacting basic trading capabilities.